How corporations, banks, and investors can better communicate about ESG

In February, The Washington Post reported on the exodus of ESG asset managers, highlighting the departure of JP Morgan Asset Management, BlackRock, and State Street Global Advisors from Climate Action 100+. A group of 700+ global investing members, CA100+ set out to convince companies to reach net-zero CO2 emissions by 2050 through ESG mandates. The campaign saw success, with 75% of their targeted companies committing to net-zero emissions by 2050.

So why are these major asset managers now leaving the ESG space they built up? The problem lies in how we communicate ESG.

What is ESG, anyway?

First, let’s look at the term ESG itself. The term was coined in 2004, appearing in a report released by various banks and investment groups, Who Cares Wins. As stated in the report, the goal of ESG was to “develop guidelines and recommendations on how to better integrate environmental, social and corporate governance issues in asset management, securities brokerage services and associated research functions.”

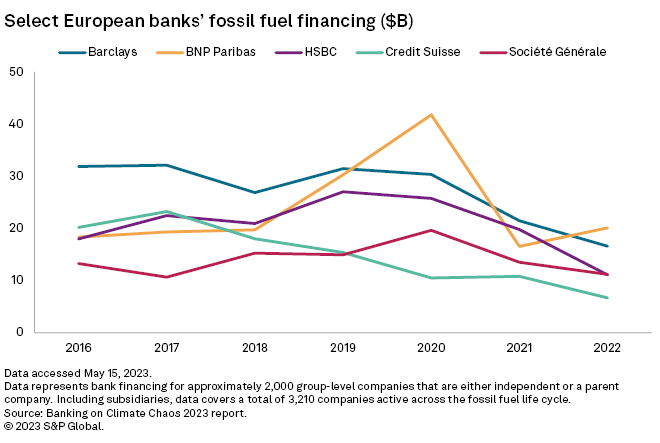

It sounds great, to be sure, but gets a bit confusing when you consider that some of the inventors of the term (BNP Paribas, Credit Suisse Group, HSBC) are also some of the world’s largest fossil fuel financiers. BNP Paribas, for one, increased its fossil fuel financing in 2020. However, when you search “BNP Paribas climate impact,” you’ll find a plethora of self-produced reports, rankings, and new climate initiatives, all pointing to the company’s positive “green” impacts. At, the same time, many banks (including BNP Paribas) are now decreasing these investments, signaling the emerging global trend of transitioning away from unsustainable fossil fuels, as well as commitments to genuinely become more climate conscious.

We can begin to see a sort of environmental duality in these major asset managers’ actions. On the one hand, they have helped create the framework for ESG, actively convinced corporations around the world to commit to net-zero, and, as highlighted above, are actively reducing their investments in fossil fuels. On the other hand, fossil fuels are still a major aspect of the global economy and worldwide accessibility to energy, especially in developing countries. While the goal is to continue transitioning to renewable energy, these groups feel they cannot abandon the reality of the world they live in, which is—for the time being—reliant on fossil fuels.

Additionally, these groups find themselves bullied by social pressures from either extreme that end up altering company values for better or worse. Some argue that ESG goals are not enough, that there needs to be more accountability, making the ESG process more robust, but also more challenging for companies to follow who have not yet cemented the framework for major climate transitions. Others argue that there is still a need for fossil fuels and that these standards will hurt our economy, highlighting the financial reality that large scale climate transitions can be costly. Both sides argue that there is no real transparency and that major corporations are “greenwashing” by simply creating reports with climate terminology fodder.

How to communicate about ESG

The exodus of ESG asset managers is the culmination of this politicized climate pot beginning to boil over and investors wanting to avoid the crossfire. More intense ESG requirements and expectations have spooked major investing groups for a variety of reasons. One reason is that as ESG standards intensify, investors see more red tape and hoops to jump through. In addition, they likely realize just how politically weaponized the term “ESG” has become and therefore choose to avoid the association altogether.

So, what do we do? It is a tricky task to please both sides of this ESG tightrope. We see this playing out in the media today, every day, on every topic, with both sides spouting arguments as to why the other side is wrong, fueled by the information age.

The reality is the world is still dependent on fossil fuels and the sustainable energy transition is here.

What these asset management titans need to do is reevaluate their ESG communication. By communicating transparently that there is a need for both, they can begin to foster their relationship with both sides. There will always be disagreement—this is the nature of politics—but an investment group with the influence on massive populations must, in fact, cater to a large audience. Leaders need to be balanced about the reality of fossil fuel necessity during this transitional period, as well as that the energy transition is upon us and the survival of the planet means transitioning to innovative, sustainable energy sources.

When it comes to ESG, to put it bluntly, leaders need to communicate better. Without details and facts, critics on both sides are left to fill in the blanks, which is where we find ourselves today.

As critics and individuals, we have the responsibility to sharpen our eyes as we ingest corporate ESG reports. We need to educate ourselves on the intricacies of ESG and the reality of the present.

William Sadler is a Senior Account Executive at Qorvis. He is a certified Terra.do Climate Fellow, which allows him to provide strategic counsel to clients across the Qorvis portfolio who are navigating effective communications about their climate, energy transition, and ESG plans.